Market Clearing and Utilization🔗

The Market and Utilization sector uses a market clearing theory to balance supply and demand given costs, prices, and assumed market attributes. Market prices depend on the demand/supply imbalance. They also depend on the cost of energy production by existing capacity, which depends on technological cost improvements, and resource constraints and overheating of capacity, all described in Supply.

Market Clearing of Fuels🔗

The market clearing of fuels captures the supply/demand/price of each fuel at the extraction level, i.e., minemouth (coal), crude (oil), wellhead (natural gas), and feedstock (bioenergy). The production supply of fuels is a logistic function of the ratio of the market price to variable cost relative to the initial market price to variable cost; when that ratio equals 1, the utilization of production capacity is at the normal utilization of 0.8. The demand for fuels is the sum of the demand for each carrier. The indicated price of fuels is a function of the current price, the demand/supply imbalance, and the unit cost of production of existing capacity. The actual price is the indicated price lagged over the price adjustment time (0.5 years). The price of each fuel for each carrier that uses it is the market price of the extracted fuel increased by a carrier and end use specific markup value, plus the net of any taxes and subsidies. The price for the industry end use is also explicitly determined for the capacity with CCS.

The demand for each fuel for direct use (nonelectric and nonhydrogen) consumption is the product of the long term demand and its utilization, which is a linear function of price relative to the reference price; the response of utilization to price is given by the (negative) sensitivity. For industry, that demand is determined explicitly end use capacity using CCS and that not using CCS. The former is the product of utilization with CCS and the capacity using CCS equipment, determined by the CCS capacity and the utilization of that CCS capacity, all defined in Carbon Capture and Storage (CCS). The latter is the product of utilization without CCS and the capacity not using CCS equipment.

The demand for each fuel for electricity generation is determined in the market clearing for electricity. The actual production of fuels for direct use consumption for energy and feedstocks, power generation, and hydrogen production is constrained by the production of extracted fuels from their market clearing.

Market Clearing of Electricity🔗

The market clearing for electricity is comparable to that for fuels. However, for electricity, the utilities aggregate the production from all sources and charge a single price to the consumer. Furthermore, the busbar price reflects the revenue of the utilities; the market price of electricity adds the transmission and distribution (T&D) costs to that. The consumer pays the T&D costs, defaulted to $0.02/kWh, to the utility regardless of the electricity generator. T&D costs are not subject to the learning or breakthroughs; they are assumed to remain constant throughout the simulation (see EIA 2017 and Fares & King 2016). The generator's unit revenue may also be increased according to qualifying credits, explained below in Clean Electricity Standards, and by any applicable CCS subsidies. The busbar price relative to the variable cost of each production source determines the utilization of production capacity. As described for direct fuel use carriers for industry, for the primary fuels with potential CCS, utilization is determined explicitly for revenue and costs with and without CCS. The production of electricity by each fuel is the sum of the production with and without CCS. The former is the product of energy utilization with CCS and the capacity using CCS equipment, determined by the CCS capacity and the utilization of that CCS capacity, all defined in CCS. The latter is the product of utilization without CCS and the capacity not using CCS equipment.

The market price of electricity determines the utilization of the end use demand capital. The demand for electricity is the product of the long term demand and its utilization; electricity required for direct air capture, carbon capture and storage, and hydrogen production are added. The indicated busbar price is a function of the current busbar price, the demand/supply imbalance, and the average unit cost of production of existing capacity, weighted by the production of each electricity source. The actual price is the indicated price lagged over the price adjustment time (0.5 years).

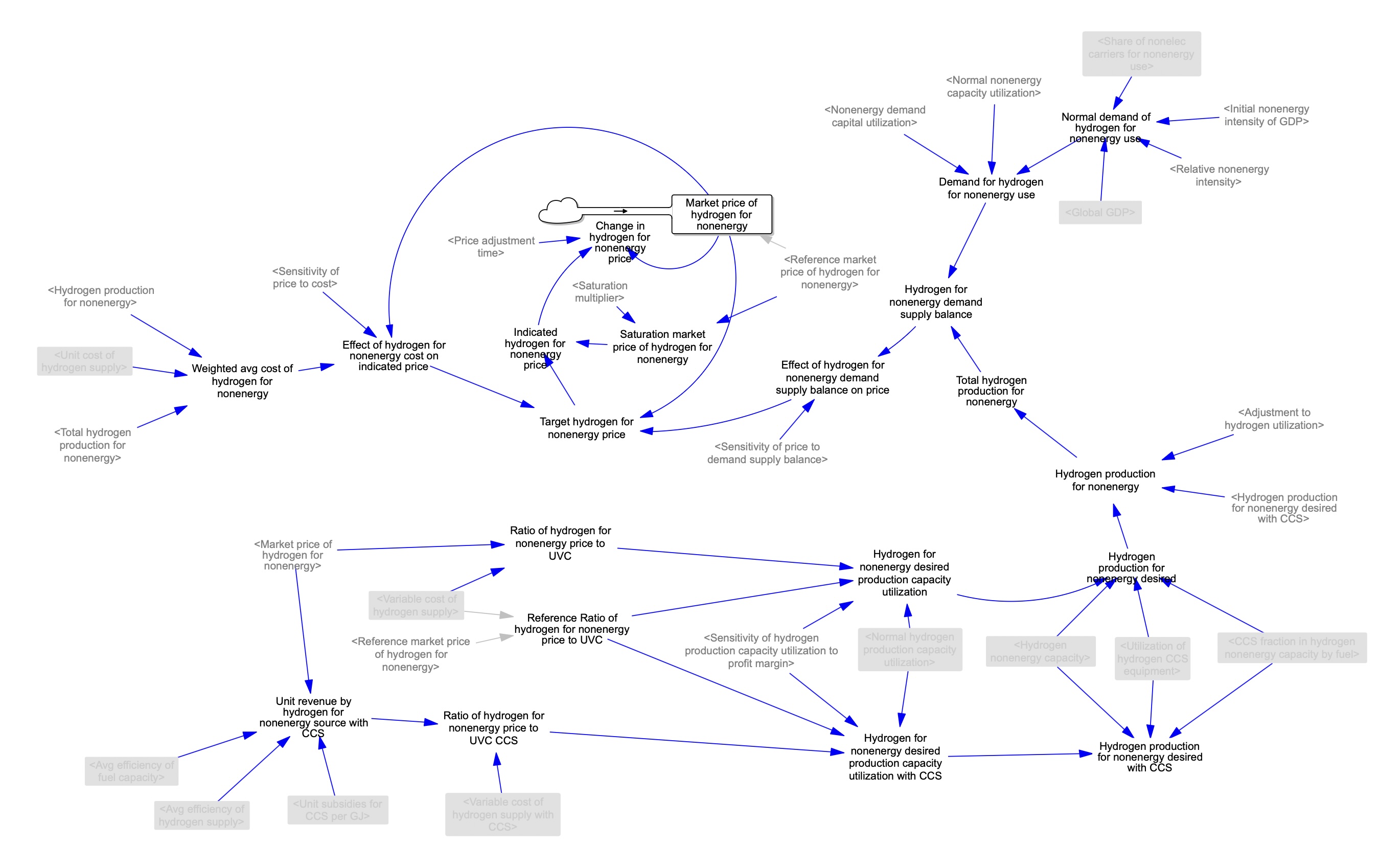

Market Clearing of Hydrogen🔗

The market clearing for hydrogen parallels that for electricity. However, there are two distinct market clearings for hydrogen, one for energy and the other for use as a feedstock. As explained in Hydrogen Supply Choice, the main difference is that, due to the inefficiencies in producing hydrogen with fuels, they would only be considered for use as an energy carrier if the associated emissions were abated by CCS. On the contrary, hydrogen as a feedstock needs hydrogen molecules as an input to certain chemical processes (e.g., producing ammonia NH3 for fertilizer production) and therefore the unabated fuels are often chosen as the most attractive sources. Another complexity with hydrogen production is that it can be used to store variable renewable energy for electricity. Hydrogen for this purpose is not included in the market clearing because it is not traded on the market; rather, the hydrogen produced for it is subtracted from the total produced for energy and VRE storage.

Moreover, hydrogen for VRE storage preferentially relies on the electric grid and dedicated renewable sources. Electricity from the grid that is used to produce hydrogen factors into the Market Clearing of Electricity. Convention differentiates the sources of hydrogen by color.

Tax and Subsidy Adjustments to Costs🔗

A carbon tax on fuels and source taxes reduce the margin and profit of that source; conversely, source subsidies increase the margin and profit of that source. Source taxes/subsidies can be applied either to capital costs, as defaulted for electric and hydrogen sources, or to variable costs, as defaulted for fuels. Carbon taxes, which depend on the fuel's carbon density and fuel losses, increase the variable costs of that fuel. For fuel-generated electricity, the adjustment to the cost of fuel also depends on the thermal efficiency of that source. The increase in cost with a carbon tax can be partially offset with the net of CCS costs minus incentives.

Parameter values for source subsidy/tax inputs range from highly subsidized, defined to be 60% of the marginal cost in 2020, to very highly taxed, defined to be 200% of the marginal cost in 2020. For fuel-generated electricity, the percent thresholds apply to the marginal costs excluding those for fuel. Bounds are set to policy-relevant limits, which are source-dependent.

Clean Electricity Standards🔗

Besides taxes and subsidies, market-driven credits or certificates are another mechanism to drive electricity to achieve target standards. En-ROADS allows the user to choose the sources to be counted as qualifying, the target percent of qualifying sources of electricity produced, the duration over which to achieve the target, and the base cost of the credits or certificates. The costs of buying certificates and potential fines for not reaching the standard are paid for by all sources, whereas only qualifying sources reap the revenue.

Model Structure🔗